Welcome to our Best Practices Series, in which we will document our own learnings in building systems and operations across various industries. Today we will be looking at Credit Management Best Practices. The goal is to give back to the business community and show how you can help make your company better.

Credit Management Best Practices: Building a World Class Credit Department

Credit makes the world go round. In nearly every type of Industry, having access to easy credit is the key to allowing for seamless transactions to take place. Without this life blood of the common economic system, many businesses would cease to exist, and breaking into an industry would require an inordinate amount of start-up capital, which most businesses wouldn’t have access to. So what is a modern-day business to do? The answer to that is to create a world-class credit department by adopting credit management best practices.

What Does a Credit Department Do?

The credit department is the lifeblood of a well established sales process. If sales are made on credit, it is only when the cash is finally collected that the sale can be final and complete. The credit department is charged with managing the cash conversion cycle, which is the process of converting a sale to the final product: cash in house.

While the sales department is the engine of company, the credit department can be viewed as the gears and oil that make the engine work. The two functions are complimentary; without one vital component, the engine will stall up and cease to work. Only by sales and credit working in a collaborative environment can a company function at its highest level.

Why is the Credit Department Important?

Accounts Receivable is typically the largest asset on a company’s balance sheet. Think about this for a second, you and your sales team work day in and day out to obtain a large customer account. Once you make that sale, you now need to finalize the terms of the contract. Perhaps the negotiated terms come to be 50% payment upfront and 50% payment upon completion on a $1 million dollar contract.

The predicament that the company now finds itself in is non-payment risk on the $500k credit amount. This is certainly a material dollar amount that organizations need to account for.

What happens if while during the project the counterparty decides that they no longer needs the product and now refuses to pay the remaining $500k? Or what happens if the software is delivered on time yet the customer is struggling in their industry right and is not able to pay the $500k when due?

The seller will now find itself in a situation where they have delivered the product but might not be paid for their hard work. As a result, a loss is incurred on the sale and the company will need to make up for loss in margins. See our insight on Margin Analysis.

A well-run credit department seeks to identify this type of risk in the beginning of a relationship and to establish an upfront risk mitigation plan. In my own tenure in the credit world, I have found that identifying and taking steps to mitigate the risk from the beginning is a far better practice than taking risks and dealing with the consequences down the road.

Best Practices for Credit Departments

Below are some of the credit management best practices for companies to implement across their departments. Are these the ‘end-all be-all’ of credit management? Definitely not. Rather, these are some of the best practices that I have seen and implemented in my own work experience which have lead to fantastic results.

***At Ramey Consulting, we are experts in operations management! If you have a project you are looking to get off the ground or best practices initiatives you are looking to undertake, we can help. We specialize in Finance, IT, and Website + SEO. Contact us today!***

1. Document Policies and Procedures

Documenting what the policy is going to be and sticking with that as much as possible is a key to success. While circumstances can and will allow for deviations from the plan when margins justify the increased risk, in the majority of cases, a well-defined credit policy can be the ‘guiding light’ for the organization in dealing with the particular situation at hand.

2. Establish Credit Limits with Sign Off Levels

Another principle for solid credit departments is to establish credit limits and sign off levels throughout the organization. Often times I see that credit limits are a standard practice but sign off levels fluctuate. What I mean by sign off levels is to have a certain dollar amount level that a particular position or committee can approve. For instance, sign off levels might go something like this:

- Credit Analyst: $100k sign off level

- CFO: $250k sign off level

- President: $500k sign off level

- Board of Directors: $500k or above

With each subsequent sign off level, more hands need to approve the decision. Keep in mind this is not to delay or hold up any potential deals. An organization must always remain nimble and quick. Rather, having sign off levels established helps to ensure proper risk management through multiple inputs throughout the organization.

By having more individuals involved in the higher dollar amount deals, the organization can better protect itself by having questions asked that will help flesh out potential risks and downsides. This will help verify and justify that the upside is truly worth the business investment.

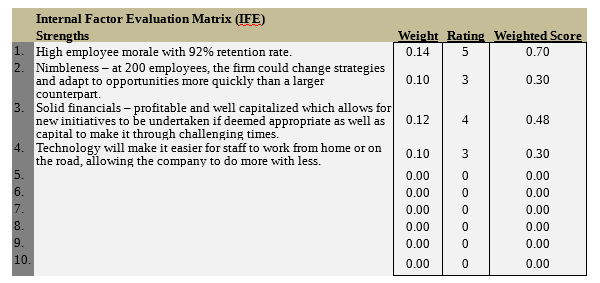

3. Develop a Risk Rating System

A risk rating system (RRS) is a must for any organization looking to make their credit department world-class. The RRS will help prioritize departmental focus, categorize outstanding A/R by risk rating levels, and create a better data set for reviewing, sorting, and decision making. While companies can exercise their own judgement in regards to setting levels, I recommend the following RRS:

“1 – Prime”

Typically 5-10% of overall A/R portfolio

These customers are in top financial condition with risk of incurring a bad debt at a very low percentage. The department will rarely needs to review these customers as the risk of bad debt is very low, perhaps non-existent. If these customers experience financial struggles, it is due to macro-events that are negatively affecting the economy as a whole. The more likely case for bad debt loss will be through improper contracting, shipment, delivery or build-out issues, which is primarily in the sales or customer service prevention realm.

“2 – Good”

Typically 10-20% of overall A/R portfolio

These customers are still in great financial condition, with the risk of a bad debt very low or non-existent. The separator between prime and good customers is that prime customers are the large, stable customers – typically the biggest players in the industry – that can survive any micro or macro event that will happen to them. Good risk rated customers, on the other hand, are typically smaller than the prime rated customers, and are more susceptible to micro or macro events due to their smaller market caps and resources. With that being said, these customers should still be in solid condition and reviewed at less frequent intervals than the rest of the portfolio.

“3 – Fair”

Typically 30-50% of overall A/R portfolio

These customers will make up the majority of the A/R portfolio. Think of a typical normal distribution curve: the outliers will be the really great payers and the really bad payers. The majority of the customers will then lie somewhere in the middle. These are the customers that will take up a majority of the A/R department’s time simply due to the overall size of the customer base. Most of these customers are well meaning, with high levels of character, but might struggle to pay when cash is tighter due to seasonality issues or not having access to as much borrowing capital. These customers will require a bit more ‘hand-holding’ and reminder calls to get paid, but overall payment likelihood is higher, especially once a relationship is built with the customer.

“4 – Marginal”

Typically 10-20% of overall A/R portfolio

These customers are where the A/R department makes its money. While this part of the customer base makes up a relatively small percentage of the overall portfolio, the accounts will require a large majority of the department’s focus, time, and energy. These accounts should be reviewed more frequently, called more often, and watched closer as the capital and cash flow typically do not exist on the same levels as the 1-3 risk rated customer base. While credit can still be extended, consistent margin analysis should be completed to ensure that the risks taken in the extension of credit make sense from a cash flow perspective. Tighter controls more frequent communication should be in place between sales and credit to make sure that these accounts are getting the attention they deserve.

“5 – Sub-Marginal”

Typically 5-10% of overall A/R portfolio

These accounts are those accounts which have very poor character or very poor payment history. It is recommended that if sales are made, those sales should be made on prepayment only terms, if made at all. Frequently, these are customers with history of late payments, legal issues, and even bankruptcies. Open credit can be extended to these customers, but only if the risk are well-known and understood throughout the organization. This risk rating should be reserved only for those customers where the credit analyst believes that there are serious concerns of non-payment, legal issues, or imminent bankruptcy within the year. If a customer is risk rated at a level 5, steps should be taken to ensure that any sales made are properly protected throughout the entire process.

4. Obtain Buy In Across The Organization

Of prime importance for the credit department is to obtain internal ‘buy-in’ across the organization. Instead of using the ‘it’s my way or the highway’ approach to decision making, be sure to explain and outline any decision and its impact on the stakeholders involved in the decision. By doing so, the credit department begins to build trust and better achieves the needed ‘buy-in’ throughout the organization.

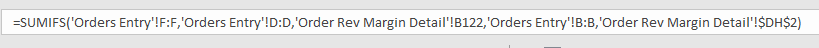

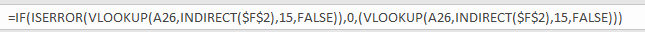

5. Automate Systems

Companies that are trending towards automation are in a better overall position to handle workloads and are leveraging technology to increase departmental focus. Take a moment to think about some reports that you or your team generate on a daily basis or weekly basis. How much time do these take up versus the value you receive from producing them? There is most likely value, but is it corresponding to the amount of time invested?

Technology is getting us to a point where those that know how to utilize it to help improve their company will get ahead. In regards to the credit department, how are you producing your aging reports? Are those reports still being produced manually? How are the sales associates being notified of past due or over limit customers? Is there a general automated email that goes out or is it your team member making calls? There is still value in human-to-human contact, but more and more companies need to be taking advantage to gain efficiencies through technological automation.

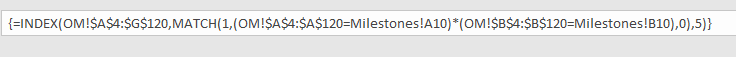

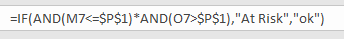

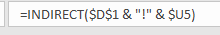

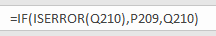

Example: In my last credit department consulting position, we implemented a risk rating system into the CRM software. In unison with the fantastic IT department, we were able to build an automated rules-based messaging notification which would flag accounts based on corresponding factors such as past due, over limit, average days payable, etc.

Before this system was implemented, over limit accounts had to be manually flagged in the software. This was a time-consuming process and caused many headaches as when the department was on overload, flags were not updated to reflect the changing circumstances. The result was frustration on both the credit and sales sides due to ‘stale’ and unreliable data.

Not only did automating the process help create instanaenous data for the entire company, but it helped the credit department do more with less. Instead of spending time manually updating credit flags, the department focused on more frequent analysis and calls on past due invoices.

Contact us to find out how Ramey Consulting can help you automate your credit processes today!

6. Have Sales Take Ownership

The sales department is a vital function of any business. Without a good sales team, companies are destined for failure. While a good sales person needs to combine a good amount of professionalism and bravado, he or she should also have ownership of selling goods and services. A recipe for disaster is to allow a salesperson to only focus on sales without any regard for the cash conversion cycle.

A good way for the company to accomplish this is to base some portion of the sales departments pay and/or bonus to the collectability of the accounts receivable portfolio. While this option is usually not popular with the sales department, it does increase the buy-in to selling to accounts that are willing and able to pay down their invoices.

Example: A best practice is to have any potential bad debt for which the particular sales individual was responsible for selling tied dollar-for-dollar against his or her bonus. By doing this, sales individuals are more mindful to the types of customers they are soliciting and as a result, those customers with lower character and/or capital are typically avoided or stringent payment terms are worked out.

Keep in mind this type of structure requires a good cooperation and trust between the sales and credit department. Without this buy-in and trust, there can be situations that arise where A/R counsels to not sell to a particular customer yet sales does not respect the decision because there is not a good relationship.

7. Be Willing to Walk Away from “Bad Money”

Not all customers are created equal. Some customers just lack the ability or character to pay bills when due. In this situation, both credit and sales needs to be willing to walk away from an open credit relationship and be wiser for doing so.

Sure, if you do take that risk, you might get lucky short-term and get paid, but a customer with poor credit will eventually miss that crucial payment. Then the company will be left chasing down a bill that will very likely become a bad debt. That is not a situation that is good for anyone at the company.

8. Educate

The credit department should view itself as an ally of the sales department. The end goal of any transaction is to always be able to sell and to maintain an ongoing relationship with that customer. One way that credit personnel can help do this is to explain the groundwork for any decision they may make.

I have personally never understood the unwillingness of credit personnel to share reasoning for a decision. I understand the idea of confidentiality and keeping a separation between sales and credit. However, there can always be a mutually respectful relationship and an understanding between the credit department and the rest of the team.

For instance, if a customer applies for credit and does not have a good personal credit report, the credit person would be wise to tell this to the sales individual to make sure that the rationale for the decision is understood. While the specific details do not need to be divulged, the sales representative will often be more receptive if they understand the reasoning behind each decision. Here is some recommended language:

“Bill, I show a continuous history of late payment from this customer. If we sell to him, we run the risk of being paid about 30 days late. What are the margins and can we afford to float this interest cost?”

“Susie, I see that other vendors have not been paid yet for their goods and there are a few items in collections. I recommend a prepay only basis with this customer, otherwise we might not get paid at all.”

Explanations like this are high-level and put both the credit department and sales department on the same page.

9. View Yourself as a Partner

In helping to build a relationship with sales, consider yourself a partner in the selling process. Your goal is to be a ‘gatekeeper’ or the ‘guard rail’ to help the sales team avoid bad debts. Keep in mind that roughly 70-80% of the selling population will be able to pay – some might take longer, some might pay sooner. The remaining 20-30% are the marginal and sub-marginal accounts; these are the ones that the diligent credit department gets paid to monitor.

Help out sales by suggesting ways to improve and increase their existing sales while minimizing their ‘bad debts’. This is what I call the “Maximizing Profits while Managing Risk” approach to credit management. When this type of mindset encompasses the entire organization, the entire company benefits. If you are a salesperson, reward your credit department for adopting this mindset and thank them regularly for helping you manage risk!

10. Take a Holistic Approach to Managing the A/R Portfolio

Managing the A/R portfolio is the main prerogative of the credit department function, however it is only one small gear in what makes up the company engine. If the credit team is too tight on credit, the company will be foregoing and missing out on profits. If the credit team is too loose on credit, then increased bad debts will adversely affect the company’s profitability.

As a credit individual, see the bigger picture and the effects your actions will have on the entire company. If you deny that company credit, then what happens to sales? What about the marketing department? Have they been working to court this company for some time and their yearly sales numbers depend on extending credit? Can you afford to take a bit more risk in this situation?

Or if you grant credit to that company that most likely will not be able to pay on time, how does that effect the entire organization? Have the goal of thinking beyond the immediate numbers into the bigger picture.

In my tenure as a credit manager, I would occasionally grant credit to customers that might take a bit longer to pay, mainly due to solid margins on the deal or the idea that the department needed to build its portfolio or break into a new sector. Once you adopt this mindset of seeing the bigger picture, you will quickly win over the hearts and minds of the organization as you work your way towards solid management of the A/R function.

11. Develop a Keen Business Sense and Trust Your Instincts

Last but not least, develop a keep business mindset and trust your instincts.

Being a good credit professional requires that you pay attention to trends which affect not only you company’s immediate customer base, but macro trends that will eventually trickle down into those customers you are selling products to. Is the stock market in decline? Are interest rates rising and your customer is carrying a lot of debt? What are the general macro trends in your customer’s sector? Knowing this information will help you make more information decisions.

At the end of the day, once the numbers have told you the story, it is up to you to assess the character of the business/owner, general market conditions, and other factors that could positively or negatively affect your customer’s ability to make payment. Make the best decision, trust your analysis, and learn along the way from each and every decision you make.

Summary

By adopting these credit management best practices and a mindset which seeks to develop alliances across the organization and customer base, credit professionals can positively impact the environments in which they serve. Make it your prerogative to keep learning, keep growing, and keep serving those in your organization on a daily basis.